Introduction

The event that is most eagerly awaited in the history of Bitcoin is called the Bitcoin halving, or "the halvening."

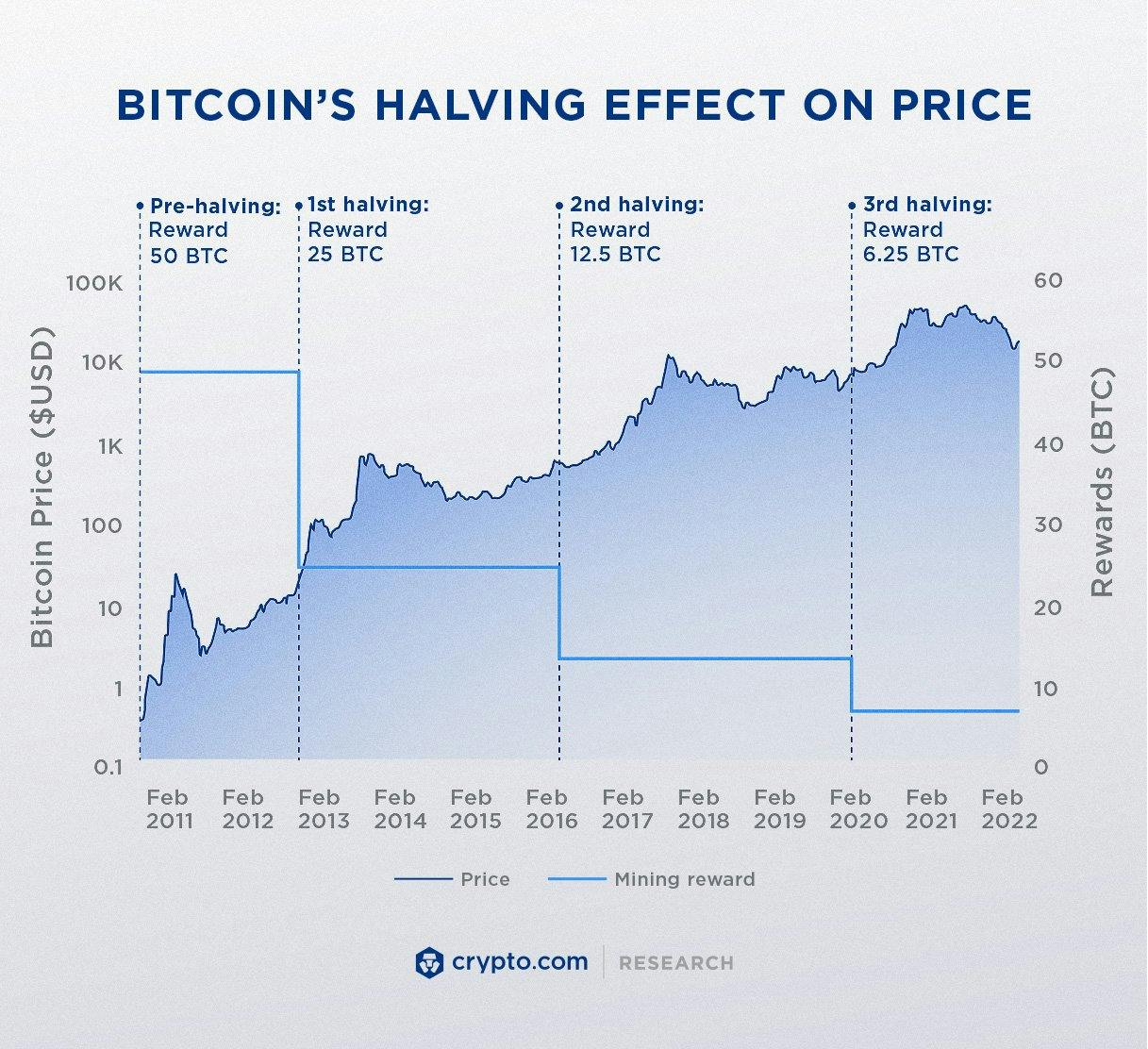

Block rewards, or the amount of bitcoin (BTC) that are released into circulation every 10 minutes, were cut in half in May 2020, from 12.5 to 6.25. This milestone was predictable since it occurs every 210,000 blocks, or roughly every four years, and it had already occurred twice before 2020.

The attraction of potential wealth is what makes these events so well-known. As fewer new bitcoin enter the market, demand should presumably remain constant, thereby increasing the price of bitcoin. As a result, the incident has sparked a heated discussion regarding projected bitcoin prices and market reactions.

However, the regular drop in Bitcoin's minting rate may be more important to the currency's operation than any short-term price fluctuations. One of the key elements of Bitcoin that guarantees the security of this leaderless system is the block reward. The economic incentives that underpin the security of bitcoin may become unstable if the rewards eventually decrease to zero in the coming decades.

What is Bitcoin Halving?

As block rewards, newly created bitcoins are created by "miners" who employ costly computer equipment to "mine," or earn, them.

The total amount of bitcoin that miners may earn is half approximately every four years. Every ten minutes, the system awarded 50 bitcoin to miners who were successful in 2009. 6.25 bitcoins are now being distributed every ten minutes, following three halvings.

When there are 21 million bitcoin in circulation, the process will come to a conclusion. The general consensus is that it will happen sometime around 2140.

Why Bitcoin Halving is needed?

Soon after publishing the Bitcoin white paper, Nakamoto outlined the possible outcomes of their selected monetary policy, which determines when miners receive block rewards. They considered the scenarios in which this policy could result in inflation or deflation, or the rise in the prices of goods and services that can be purchased with currency.

Nakamoto could not have predicted at the time how many people, if any, would utilise the new digital currency. They wrote, "Coins have to get initially distributed somehow, and a constant rate seems like the best formula," but they didn't go into any detail as to why they arrived at that specific calculation.

Due to their limited supply, Bitcoins have a high market value, which is primarily driven by their utility and scarcity.

The fact that Nakamoto designed the block reward to decline over time is another distinctive feature of Bitcoin. It also deviates from the standard for contemporary financial systems, in which the money supply is managed by central banks. Compared to Bitcoin, which halves its block reward every year, the dollar's supply has nearly tripled since 2000.

How Does the Price of Bitcoin Change with Halving?

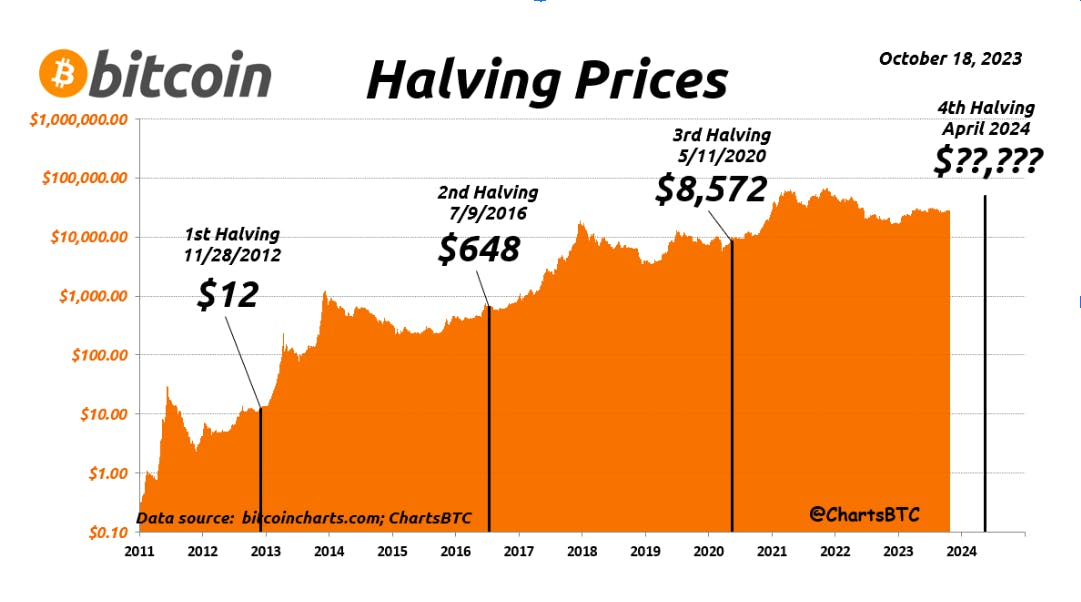

The main reason a bitcoin halving attracts so much interest is that many people think it would raise prices. The fact is that nobody can predict what will occur. One can refer to the three halvings of Bitcoin that have already occurred as precedents.

The first indication of how markets might react to Nakamoto's unconventional supply plan came with the 2012 halving. The Bitcoin community was unaware of the potential effects of an abrupt decrease in incentives on the network until that point. As it happened, the price increased soon after the halving.

The price fell by 10% to $610 on July 16, 2016, the day of the second halving, although it quickly recovered back to its previous level.

The market did finally react over the course of the year after the second halving, despite the fact that the immediate impact on the price of bitcoin was minimal. Some contend that the halving caused the increase, which happened later. According to theory, when there is less of it available, there will still be a demand for it, which will drive up the price. A year and a half after the second halving, the price of bitcoin increased by 284% to $2,506.

Examining the most recent halving, we can also observe that the price of bitcoin performed bullishly for a full year following the occurrence. It increased by about 559% this time.

What if Miners are not Incentivized?

The Bitcoin network would collapse in disarray if there were no block rewards. According to Hasu, miners can attack the network in two ways: by preventing transactions from being completed or by double-spending bitcoin if they possess sufficient processing power. However, they have a significant incentive not to attempt it as well, as doing so would mean forfeiting their block rewards.

If miners break the rules, they will lose money. It is more difficult to attack the Bitcoin network the more processing power miners allocate to the cryptocurrency. This is because an attacker would need to possess a sizable amount of processing power, or hashrate, in order to carry out an attack of this kind.

The more mining power that goes into Bitcoin, the more money they can make in block rewards, and the more secure the network is as a result.

Will one Day Bitcoin Halving Lead to 0 Incentivization?!!

For this reason, the occasional drop in incentives could potentially cause problems. However, the block rewards will eventually decrease to zero as a result of this drop. The other way miners make money is through transaction fees, which users must pay each time they send a transaction. As the block reward decreases, fees are anticipated to become a more significant source of payment for miners. The transaction fee will take the place of other payments for nodes in a few decades when the incentive becomes too tiny. Nakamoto remarked, "I'm confident that in 20 years, there will either be a very high transaction volume or none at all.

As was previously mentioned, Bitcoin is strengthened against attempts to evade the network's regulations via mining rewards, which attract additional processing power to the cryptocurrency. It's uncertain if miners will be drawn to a future reduced block reward as much, even in the presence of fees. Hasu stated, "I don't think this halving will make Bitcoin significantly less secure, but we could find ourselves in hot water in eight or twelve years."

A contributing factor in the issue is that the market is still determining the actual cost of fortifying the network against attackers, over ten years after the inception of Bitcoin.

#